An Introduction to the New Medical Savings Account (MSA) For Seniors

Choosing the right plan for post-65 healthcare can be very confusing.

Who has the best benefits? Which plan is the lowest premium? What about deductibles and networks and copays and coinsurance?

You can get into the weeds pretty quickly, which is why we’re thrilled to announce the largest Medicare Medical Savings Account on the market. It became available for sale in October 2018.

Not only is this product completely unique (in a great way!), but it’s very simple to understand.

Get a free health plan review by a licensed agent

What Exactly Is a Medicare Medical Savings Account (MSA)?

A Medicare Medical Savings Account (MSA) plan is a type of Medicare Advantage plan that combines a high-deductible health plan with a medical savings account.

You pay nothing to have the plan – it’s a $0 premium product. The government puts $2,520 into the savings account, and you’re allowed to use that money for medical expenses – anything that the IRS deems a Qualified Medical Expense.

That means you can use the money for doctor visits, your Part D prescription drugs, long-term care, hearing aids, the dentist – whatever you need to use it for.

You don’t pay anything until your $2,520 is used up, and you need to meet your deductible. In Decatur, the deductible is $6,700.

You can see why this is very attractive to those of us who are healthy and only see the doctor once or twice a year.

We don’t pay any premium, we’re given money to use for medical expenses, and if we don’t spend that money, it rolls over to the next year and starts accumulating!

Here’s a quick look at what this MSA looks like:

- $6,700-$8,700 deductible, depending on where you live (Decatur, IL is $6,700)

- $2,520 deposit

- $0 premium

- No provider networks

This is probably very different setup than what you’re used to. We know it takes some time to get comfortable with, but we have some real examples of clients who have switched from their current plan in order to get this.

Even our agents here at Sams/Hockaday have said that when they turn 65, this is the plan they’re with. It’s a very exciting time to be on Medicare!

How Does an MSA Compare to a Medicare Supplement?

It can be difficult to compare a Medical Savings Account (MSA) to a Medicare Supplement plan. The way they’re set up is very different, so it’s like comparing apples to oranges.

However, we’re going to do our best to give you the pros and cons of an MSA versus a Medigap plan. Keep in mind that both options are fantastic options for seniors – it comes down to the individual, their current health, and what kind of risk versus reward they're comfortable with.

For starters, the MSA has $0 premium, and we know that the main expense with a Medicare Supplement is the premium.

The premium you pay varies quite a bit, so we’d like to give three real-life examples of clients who have switched from a Medigap plan to the MSA.

Plan G vs. MSA Example

The first individual had a Medigap Plan G. He was paying $1,500 per year in premium.

If he had the Lasso MSA for 3 years, he would have accumulated over $7,500 in his medical savings account. Even if he spent $500 per year in medical expenses from that account, he’d still have $6,000.*

That would mean he’d have $0 out of pocket expenses moving forward. PLUS he avoided $4,500 in Medigap premiums.

This makes a lot of sense if you’re healthy and only go to the doctor for semi-annual or annual checkups.

*The theoretical examples of future savings is assuming that the deposit will be $2,520 in subsequent years. We don't know what future deposits will be yet.

Plan F vs. MSA Example

For our second example, we were discussing the MSA with a couple living in a small town. Their total combined premium for their Plan Fs was $8,000 per year – they’re in their early 80s.

Between them both, they’d start out with over $5,000 in their medical savings account. PLUS they avoid paying $8,000 per year in premiums. That is an immediate difference of $13,000!

It’s a pretty great feeling to help a couple in their 80s experience a $13,000 difference in their budget!

Plan F with Employer Reimbursements vs. MSA Example

There are a few companies here in central Illinois who offer health reimbursements for post-65 healthcare. CAT, Tate & Lyle, State Farm, and ADM are probably the most common companies we come across.

Just so you’re aware, we do have to run your employer’s plan document by the insurance company to make sure you’re eligible for the MSA. We have not had any issues with this so far.

This particular individual had a Plan F and also received up to $3,000 per year in medical expense reimbursements from CAT. They were not healthy enough to switch carriers, and they were stuck with $3,076 in yearly premium for their Medigap Plan F.

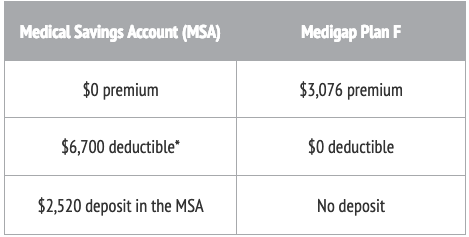

Here’s a clearer snapshot of the MSA versus their current Plan F.

So, we did some math together and determined that his financial risk is the deductible minus the deposit, which is $4,180.

He’s no longer paying the Medigap premium, which saves him over $3,000 per year. This makes his real risk $1,104.

When you add on the employer reimbursement of up to $3,000 per year, he’s actually up $1,896 for the year! And that’s the worst-case scenario. If he doesn’t meet his deductible for the year, he’s actually doing far better than that.

How is a Medicare Medical Savings Account (MSA) different from a Health Savings Account (HSA)?

A Health Savings Account (HSA) is similar yet very different from a Medicare Medical Savings Account (MSA). The MSA we’re talking about today is a type of Medicare Advantage product that’s only available to those who are ages 65+.

Here’s a chart to give us a snapshot of the similarities and differences.

For those of us in the Baby Boomer generation, we’re quite used to HSAs.

It wasn’t uncommon to hear people say they had $10,000 a year in premiums for a $5,000 deductible – PLUS they had to put $3,500 in an HSA. By the time you add all that up, you’re looking at $18,000-$20,000 out of your own pocket before the insurance company pays a dollar.

That’s what makes the Medicare MSA so attractive for us – it’s funded by the government, and if you’re healthy and don’t use all of that deposit, you have a real opportunity to accumulate funds. Those funds can be used for future medical expenses, or you can save it up to pass on to your children when you pass.

Who Should NOT Consider the MSA?

The biggest reason to avoid this MSA is if you’re not healthy and are constantly in and out of the doctor’s office or hospital.

You’d spend less per year on a Medicare Supplement, so we’d advise sticking with that.

Also, if you cannot handle the difference between the deposit and the deductible, we’d advise taking a look at some other options.

Remember: health insurance is not a one-size-fits-all decision.

Want to talk more about the MSA?

We can help you compare your current health plan to this brand new Medical Savings Account (MSA). Our help is always free of charge.

Get a Free Policy Review

Do you have the best plan with the best rate? Schedule a free policy review, and we'll help you compare all your options.

Review My Policy