Top 10 Reasons to Use a Broker for Medicare Enrollment

Technically, you can sign up for Medicare plans by yourself.

You can research the differences between Medicare Supplements and Medicare Advantage. You can make a list of all the companies that offer the plan you want. You can track down quotes for those plans and narrow it down to the most competitive option.

But is that really the best way to go about Medicare plan enrollment? We don’t think so. Here are 10 reasons to use a broker or agent for help with Medicare plan selection and enrollment.

Free Medicare 101 Email Course

From a mailbox bursting with Medicare flyers to penalties, you don’t want to miss a thing. This 5-day course features simple explanations & easy action items, so you can take control of your own Medicare plan.

Instant Sign Up!

1. Medicare education

We’ve said it before and we’ll say it again: Medicare is confusing. You can read about the Medicare program for hours and hours, and you may have a pretty solid understanding of how it works.

But our Medicare brokers stay up-to-date on continuing education, we know Medicare rules and regs (which change constantly), and we live and breathe Medicare every day.

A simple error like missing your 6-month Medigap Open Enrollment period could mean you’ll never be accepted for Medigap coverage, and if you can get approved, you may have a much higher rate for the rest of your life.

The devil is in the details when it comes to Medicare, and our agents will ensure you’re educated and supported.

2. Medicare plan selection

When you become eligible for Medicare, there are two main paths to consider:

- Original Medicare + a supplemental policy and a Part D drug plan

- Medicare Advantage

You need a solid understanding of each path so you can decide which route it best for you. There is so much to consider, including budget, risk, provider networks, your current prescriptions, managed care or not… the list goes on.

Our licensed sales agents understand what comes with each path, and as they get to know you, they can make a recommendation in your best interest.

3. Rate watchdogs

Our agents are rate watchdogs. We watch rate increases, which inevitably come for everyone.

If there’s a big rate increase on the horizon and your premium is about to increase past your comfort level, we’ll shop the market to see if we can move you to a more competitive plan.

If you buy directly from the insurance company and don't use a broker, that company is not going to encourage you to take your business elsewhere!

4. Annual check-ins

Our Medicare agents check in with clients annually, sometimes even bi-annually. This is a time for us to review your current coverage, your rates, and your needs assessment.

If you need to make any changes to your plan, even if it’s as simple as adding a new beneficiary on a life insurance policy, we keep things up to date.

Too many individuals work with an insurance agent who sells them a plan and then disappears. Our agents do not disappear. Our service continues, especially after the sale, which is when you likely need us the most.

5. Underwriting help

Our Medicare sales agents are very familiar with the underwriting questions on different company’s applications.

Say you want to switch Medicare Supplement companies, or you’re interested in adding a long-term care policy. We can match you with a company that’s most likely to accept you.

Even if you have a health condition, like diabetes, don’t assume you won’t qualify for coverage. That’s what we’re here for!

6. Benefit clarity

Did you see a commercial from a well-known company? Are you curious about all these extra benefits they talked about?

Lean on us for clarification. We offer insurance plans from dozens of companies and can provide clarity on what’s really being offered.

Sure, a plan may come with a nice dental benefit, but if a hospital stay would cost you thousands out-of-pocket, you may want to reconsider. We can help with that.

7. Searching multiple companies

A Medicare agent isn’t going to offer just one company – we offer dozens! We can look up rates for almost any company offering any given plan.

As an example, Medicare Supplement plan benefits are standardized, so if you like the Plan G benefit design, you can shop rates from every company that offers it.

Why pay more than you need to? You don’t have to when you work with a licensed sales agent.

8. Deadline watcher

Our Medicare sales agents also know all the important deadlines. Whether you’re enrolling in Medicare for the first time, or you need to re-evaluate your plans during the Medicare Annual Enrollment Period, we’ll ensure you don’t miss deadlines.

Missing a deadline could mean a lapse in coverage or even penalties that will follow you for the rest of your life.

Don’t risk it! Work with an agent who knows these critical timeframes.

9. Fast service

Customer service is important, which is why it pays to work with a Medicare agent. Here at Sams/Hockaday, we have a local office in downtown Decatur. You can schedule appointments to come to the office, but you also have a direct line to your agent. Call or email them when you need help.

You just don’t get that level of service when you work directly with an insurance company. Expect long hold times and the frustrating experience of navigating a robotic system.

10. You’re paying for it anyway

When you buy an insurance policy, an agent’s commission is already built into the pricing. It doesn’t cost extra to work with an agent… you’re paying for it anyway! So, instead of buying a policy directly from the company, lean on us!

We can shop the market and give you fast service when you need it.

Conclusion

If you’re thinking about navigating Medicare by yourself, please realize you don’t have to! Our licensed Medicare sales agents can take so much pressure off your shoulders by providing education, guidance, and support.

Schedule an appointment with one of our licensed sales agents to complete a needs assessment today.

Related: 6 Reasons You Should Work With a Medicare Supplement Insurance Agent

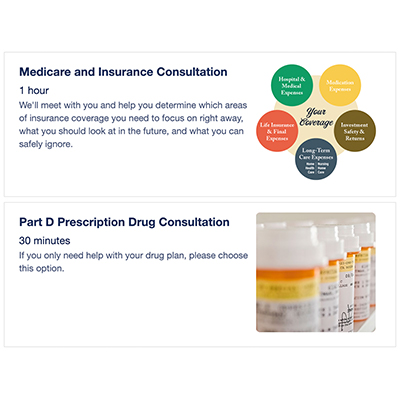

Schedule an Appointment

Book time right on our agents' calendars using our online scheduling system.

Choose Appointment